Table Of Contents

Whether you’re a brand new investor trying to do it yourself or you have a million dollar portfolio and have a team of professionals, it’s always a good idea to have foundational knowledge of each aspect of your business. I developed this comprehensive guide to allow real estate investors on every level better understand IRS Schedule E.

While real estate tax can be complex, this guide is written for investors of all skill levels. I could have made it cumbersome and technical, but then my audience would be other CPAs which isn’t the intent of this article, much less The Real Estate CPA™ as a whole.

Let’s begin by highlighting all the great knowledge you’ll walk away with after you get through this article:

- What IRS Schedule E is and how it interacts with your tax return

- Why we report rental property on IRS Schedule E

- Calculating the basis and depreciation of your rental property

- A walk through of IRS Schedule E

- How to report auto expenses

To get the most out of this post, it will be helpful to download a copy of the IRS Schedule E and its instructions here. Hopefully the combination of IRS Schedule E, its instructions, and this awesome post will make it clear as day; that is, if you think taxes can ever really be “clear.”

What IRS Schedule E is Used For

IRS Schedule E is the form where you will report “supplemental income and loss” related to rental real estate, royalties, estates, trusts, partnerships, and S-Corporations. Emphasis on the fact that we are reporting “supplemental income and loss” and not “earned income.”

Think of earned income as business income. Earned income is generated from an active trade or business. You pay self-employment tax on earned income. Real estate, royalties, partnerships, and S-Corporations can all generate earned income.

For example, you may run a real estate business where you are flipping or developing properties where you’d be required to report your income on IRS Schedule C; the schedule in which you report earned income.

Or you may be an owner in a partnership or S-Corporation and have a combination of earned income and supplemental income. In this case, one business can be reported on both IRS Schedule C and E.

IRS Schedule E is used for supplemental income which is generally considered passive income. As an investor, this is important because rental real estate generates passive income and, as such, we will report the income and loss from rental real estate on Schedule E.

How IRS Schedule E Interacts With the Rest of your Return

When you report income or loss on Schedule E, that income or loss is “re-routed” to different areas within your tax return. Your total taxable income or loss is reported on line 26 of Schedule E.

The first and most important place you will see the end result of IRS Schedule E appear is line 8 of your IRS Form 1040. Here you should see the full amount of net income or loss from your rental properties.

If your activities on IRS Schedule E created a loss and your loss is not showing up on line 8 of IRS Form 1040, you may be limited by the Passive Activity Loss rules. While the Passive Activity Loss limitations demand an entirely separate post on their own, here’s a high-level overview:

- If your adjusted gross income (line 11 of IRS Form 1040) is less than $100,000, you are able to take the loss reported on line 26 of Schedule E up to a maximum amount of $25,000 annually.

- If your adjusted gross income is between $100,000 and $150,000, the maximum $25,000 is slowly phased out.

- If your adjusted gross income is over $150,000, you cannot claim the passive loss reported on Schedule E unless you qualify as a real estate professional.

The last point is very important to understand. If your adjusted gross income is above $150,000, you cannot claim your passive losses against your other income unless you are a real estate professional.

Wait, What? I can't Deduct my Passive Losses?

Many investors get worried when they hear this. They’ve been told real estate is a beautiful way to shelter income from taxes but now they are being barred from taking the well-deserved losses.

What happens to the losses if you cannot claim them? They are called “unallowed losses” and are reported on IRS Form 8582. This form serves as a catchall that will keep track of all the losses you have not been able to claim over the years.

You do not “lose” these losses; they are simply carried forward until they can offset net rental income. These losses can also be used to offset the gain if you were to sell a rental property, regardless of whether or not the rental property you are selling generated the specific loss.

If the losses get carried forward and you can’t use them, doesn’t that defeat the purpose of sheltering income from taxes?

This is where I have to tell you that you’ve been gurued.

Real estate is indeed an excellent way to legally avoid taxation, but for high-income earners, you will only be avoiding tax on the rental income, not your regular income from your job.

Again, some amount of income or loss from your rentals should appear on line 8 of your IRS Form 1040. If your adjusted gross income is over $150,000, then you should look for IRS Form 8582 and see if the rental loss has been carried over to it.

Determining Property Basis and Depreciation

One of the most important parts about preparing IRS Schedule E is making sure that we are accurately calculating the rental property cost basis.

The most common advice is that the rental property basis is the purchase price plus improvements. So if you buy a property for $100,000 and add $10,000 in improvements, the property basis is $110,000.

This advice, while correct, can be misleading. If you are unaware that you must allocate a portion of the purchase price to land, you will calculate the wrong depreciable basis and therefore deduct an incorrect amount of depreciation.

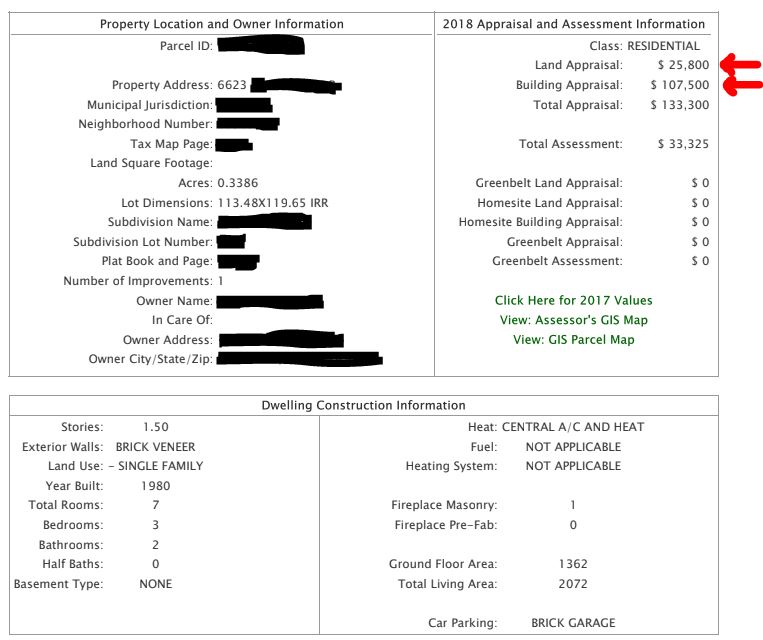

It’s important to understand how to determine the value of the land of a purchased property. In most cases, the easiest way to get this value is to pull the property’s tax card from the county assessor’s office. Doing so will provide us with a “land ratio” which we will then apply to the purchase price.

For instance, if the property tax card says that the land is worth $10,000 and the improvements are worth $40,000, then our land ratio is 20% [$10,000/($10,000 + $40,000)]. We would then apply this ratio to the purchase price of the property to determine how much value we allocate to land and how much we allocate to improvements.

See a sample property tax card below:

Why is this important? Because we can only depreciate the value of improvements since land is non-depreciable. Land is everlasting and does not deteriorate.

A too common mistake I see is depreciating the entire purchase price of the property. This is not correct accounting and will need to be corrected via alternative methods. Don’t make this mistake!

Okay, now that we know we can’t depreciate the land value of the building, let’s figure out how to calculate the property basis.

The first thing that I do when preparing IRS Schedule E is a closing cost analysis.

I recommend using a tool, calculator, or guide to help you with the analysis of your closing costs and depreciation because you are going to be lumping costs into three distinct categories:

- Property basis

- Loan cost basis

- Currently deductible expenses

The Property Basis

The first category, the property basis, consists of the agreed-upon purchase price, plus closing costs like title insurance, transfer taxes, inspections, appraisals (if paid outside of closing), travel costs, attorney fees, and notary or bank fees.

From the property basis, we’ll subtract out our land value to determine the total value in which we will begin depreciating. This is called the depreciable basis.

Purchase Price + Closing Costs – Land Value = Depreciable Basis

Depreciation will usually be over a period of 27.5 years. If you are investing in commercial property or short-term rentals, you’re looking at a 39 year period.

Related: How to Calculate Rental Property Depreciation Expense

There are several depreciation methods and conventions. We will be using the Modified Accelerated Cost Recovery System (MACRS) for our depreciation purposes.

While it sounds like a mouthful, all you need to know is that when you first place a property into service (i.e. advertise it for rent), you will be granted a half month of depreciation. Then, during the first year, you’ll calculate depreciation on a monthly basis.

So if I buy a property and advertise it for rent on September 29, for the first year I’ll have 3.5 months of depreciation (1/2 September + October + November + December). If my annual depreciation is $1,200, I first divide that value by 12 to get it on a monthly basis, then multiply it by 3.5 to figure my first year of depreciation. In our example, it will be $350.

The Loan Cost Basis

The second category is the loan cost basis which is the sum of all costs associated with the loan. These can be the origination fee, credit report, bank fees, and appraisal fees if one was required by the lender.

Once we calculate the loan cost basis, we will need to determine our annual amortization. Amortization essentially means the same thing as depreciation, it’s just the depreciation method for “intangible” costs.

You will amortize your loan costs over the life of the loan. So if you have a 15-year loan, your amortization period is 15 years. If you have a 30-year loan, your amortization period is 30 years.

Let’s assume our loan cost basis is calculated to be $3,000 and we have a 30-year loan. Each year, you will write-off amortization expense of $100 ($3,000/30 years).

The first year of amortization is calculated much like depreciation in that you will be granted a half month for the month you place the property into service and then amortize on a monthly basis until the end of the year.

Currently Deductible Expenses

The third category is currently deductible expenses which consist of hazard insurance, property taxes (not transfer taxes), and other miscellaneous expenses. These expenses do not need to be amortized or depreciated (whew!) but are simply deducted in full the first year.

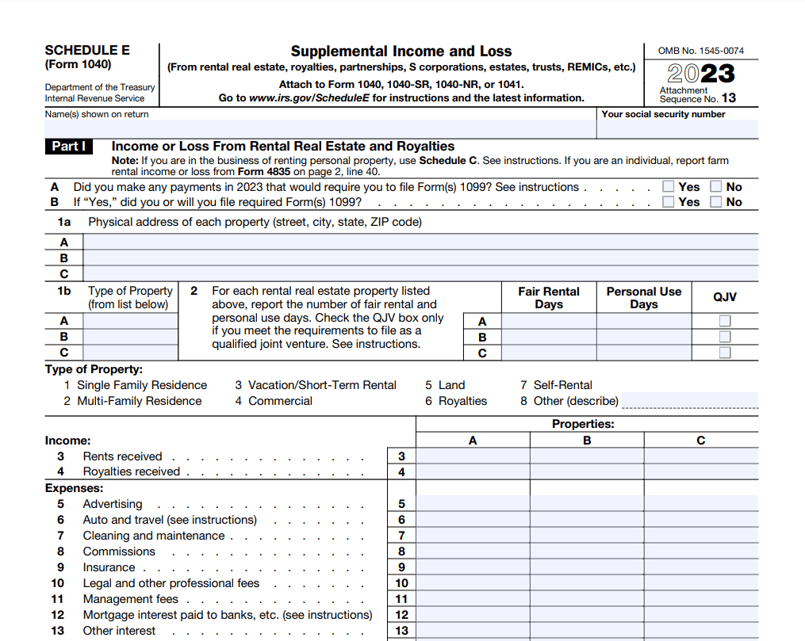

Reporting Rental Property on IRS Schedule E

Finally, what you’ve all been waiting for! Before we begin, Google search for the most recent IRS Schedule E and download it so that you can follow along.

For the do-it-yourself investors, this section will be your tax preparation bible. For all of my clients and everyone who already has a CPA, use this section to cross-check the CPA’s work.

The first section is seemingly the easiest but trips plenty of folks up. First, we have to determine whether or not we made any payments that required a 1099. As a general rule, you must issue a 1099 to contractors whom you’ve paid over $600 for work during the year. And if your rental activities rise to the level of a trade or business, you will need to issue 1099s to vendors.

Iif you are a landlord with rentals qualifying for the IRS Sec 199A deduction, tick the "yes" box when asked if you made payments that require a 1099.

Otherwise, tick "no."

Next we’ll enter the property address and the type of property (single-family, multifamily, etc). Hopefully this doesn’t require much more explanation.

Now we need to determine fair rental days, personal use days, and whether or not we are operating a qualified joint venture.

For fair rental days, put the number of days the property was actually rented and producing income. This is especially important if you have rented the property for 14 days or less as then your rental income won’t need to be reported.

Personal use days must also be inputted and can sometimes be confusing. You will only input personal use days if you have used the entire building for personal purposes, or anyone in your family has used the entire building for personal purposes.

So, if you are house hacking (living in one unit and renting out the others), you will not report any personal use days. Instead, you will just split common expenses (mortgage, insurance, property taxes) between IRS Schedule A and E.

A qualified joint venture most often occurs when two spouses own a property 50/50 and do not live in a community property state (Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin).

If the spouses of a jointly owned rental live in a community property state, there is no need to worry about, or elect, the qualified joint venture status.

When rental property is jointly owned by spouses who are not located in a community property state, we have a problem. The spouses must either report their income and losses on a partnership tax return (complicated!) or elect the qualified joint venture status.

Per the IRS Schedule E instructions: “If you and your spouse each materially participate as the only members of a jointly owned and operated rental real estate business and you file a joint return for the tax year, you can elect to be treated as a qualified joint venture instead of a partnership.”

When you and your spouse jointly own an entity that owns your rental property, it can get complicated fast. That discussion is beyond the scope of this post, but you will need to speak with a CPA to sort everything out.

Income and Expenses to Report on IRS Schedule E

Next we are going to report the rental income received. This is going to be all gross income received from your tenants throughout the year. Gross rental income should include: rental income, refunds received for utilities, and pro-rated rents when you purchased the property.

Expenses are where tax avoidance (legally) comes into play. I wrote a quick blurb on what to report per expense item:

Advertising – include all general marketing and advertising costs. These can include the cost to place rent signs in the front yard, to advertise on certain websites or publications, to buy business cards, and to send mailers.

Auto and Travel – include all ordinary and necessary auto (to be discussed later) and travel costs required to maintain your rentals. This should not include auto and travel costs incurred to purchase your first rental or to expand your rental business into a new geographic location. Also include 50% travel meals.

Cleaning and Maintenance – include all cleaning expenses to prepare a unit for a tenant or once a tenant moves out. Include maid expenses here as applicable. You should also include maintenance expenses such as painting, mowing, and small upkeep costs of the building, appliances, and equipment.

Commissions – include realtor or property management commissions paid to find a tenant for your unit.

Insurance – include homeowners, hazard, and flood insurance here. Do not pro-rate your annual insurance. You will only report the amount of insurance that you actually pay to your insurance company, not the amount that you pay into escrow.

**A note about escrow – it’s very common to pay insurance and property taxes into escrow on a monthly basis. This protects the lender from your failure to pay these expenses. It’s important to understand that when you pay these expenses into the lender’s escrow account, this is not a deductible expense for you. It is only deductible once the lender actually pays those expenses to the county/city or the insurance agent. That’s when you can deduct the expenses. Why? Paying into escrow is essentially moving money from pocket A to pocket B. It’s still your money and technically an asset on your balance sheet.

Legal and Professional Fees – include expenses related to attorney fees, accounting, and costs of business/financial planning related to your rentals.

Management Fees – include the cost to hire an agent or property manager to manage your rental. This may also include special service calls that the property manager incurs to check on the rental.

Mortgage Interest Paid to Banks – include the amount of interest reported to you by the bank on Form 1098. This amount will be the entire interest the bank has received from you during the year, including the interest you paid during closing.

Other Interest – include the amount of interest paid to third parties, whether they are private investors, private businesses, crowdfunding platforms, or relatives. Also make sure that you have sent these people or parties a Form 1099 showing the interest you have paid them. Without a Form 1099 in this case, you may not be able to substantiate the deduction.

Repairs – include all repairs made to the property that were not considered capital improvements. Expenses here will be small repairs and not the replacement of floors, roofing, etc. You may also include De Minimis Safe Harbor expenses here if they are less than $2,500 and you make the annual election.

Supplies – include the cost of incidental materials and supplies such as paper for printing, small tools, and other small miscellaneous materials that don’t fit into another category.

Taxes – include all tax expenses incurred as a result of owning and operating the rental property. This can include property taxes, school district taxes, and special easements or land taxes. Do not include income taxes.

Utilities – include utility expenses that you have personally incurred, even if the tenant has reimbursed you for them. Do not include utility expenses that the tenant has paid for without you ever having to pay for it. The reason we include utility expenses here even if the tenant has reimbursed you for them is that we are reporting the reimbursement as income at the top of IRS Schedule E and we want to offset that income with the expense you incurred.

Depreciation Expense – include the depreciation expenses that you calculated. Depreciation is an imperative part of IRS Schedule E; don’t mess it up!

Other (list) – include all other expenses incurred while operating the rental but that did not directly fit into any of the categories above. Examples of these expenses may include bank fees, education, HOA fees, subscriptions, cost of books, De Minimis Safe Harbor (if not reported in repairs), meals and entertainment, and gifts to clients or tenants. You will itemize each of your “other” expenses on a separate page.

Adding it All Up

Once we have all of the expenses inputted into our IRS Schedule E, we add them up and subtract them from our gross rental income. The income or loss for each property will be reported on line 21; if line 21 is a loss, line 22 will show you how much of the loss you can actually deduct.

Line 24 will show you the total net income each property has produced if each property showed net income. If the property instead showed a loss, and you are able to take that loss, you will see the amount on line 25.

Remember, your losses may be limited due to the Passive Activity Loss rules. All of that information will be reported on Form 8582 so definitely review that form if you are showing rental losses.

Line 26 of IRS Schedule E will show the total income or loss that will be reported on line 8 of our Form 1040. But before we calculate line 26, we need to look at Part 2 of IRS Schedule E to report any partnership or S-Corporation income and losses.

Partnerships and S-Corporations will provide you with an IRS Schedule K-1 at the end of the year. That information will be reported on Part 2 of IRS Schedule E.

Basically, we are reporting the name of the partnership, whether it’s a partnership or an S-Corporation, whether it’s foreign-owned, and what the employer identification number (EIN) is.

We will then want to report the passive income and non-passive income received from the partnership or S-Corporation. This information will come directly from IRS Schedule K-1 that the partnership or S-Corporation provides you.

Entities must go through the same type of reporting we are doing here with IRS Schedule E. While they use different forms, they are reporting the same information and then providing that information on a summarized form – IRS Schedule K-1.

If you have not received IRS Schedule K-1 but you have an ownership stake in a partnership or an S-Corporation, you have a couple of options. The easiest thing to do is file an extension and wait to file your returns until you actually receive the IRS Schedule K-1. The other option is to go ahead and file your returns, and then file an amended return once you receive IRS Schedule K-1.

Okay, that wraps up IRS Schedule E for the most part. Whatever appears on line 26 will also appear on line 8 of your Form 1040. Make sure that flow is happening correctly to avoid issues.

Reporting Car Expenses and What You Need to Know

You’ll use IRS Form 4562 (link here) to report your car expenses and claim those beautiful IRS deductions.

First thing first, if it isn’t documented, you can’t take the deduction. Document everything!

Related: The Real Estate CPA Podcast, Episode #1 - Documentation: The Key to Tax Savings

Next, the question is what should we be documenting? That’s a great question and it depends on your overall strategy.

Many tax advisors recommend using the “actual expense” method in which you record all of your car expenses incurred throughout the year and deduct the portion allocable to the business use. However, it’s important to have a good idea of payoff vs. effort.

Recording and documenting actual car expenses can take a considerable amount of effort. Sometimes, the additional deduction the actual expense method will grant you over the “standard mileage” method simply isn’t worth your time.

I know, you’re probably shocked that a CPA is recommending leaving money on the table. I’m just trying to be realistic.

CPAs want to save you every penny possible without regard to the time it takes you to put all of this information together. They do this because they can show you how much more you saved by working with them and then they can charge you a higher rate.

But if it takes you an additional 10 hours throughout the year to document an additional $500 in deductible business expenses, your tax savings will be your marginal rate multiplied by that $500. So if you’re in the 25% bracket, you’re additional 10 hours of work has saved you $125.

Congratulations, you’ve paid yourself an hourly wage of $12.50.

Now, a $12.50 hourly wage is better than many people, but you are a real estate investor. You have a business to run. Your hourly wage should be over $100.

Related: Tax Write Offs for Car Business Expenses

So what’s my point?

Spend some time estimating your annual deduction using both the standard mileage rate and the actual expense method. Determine, up front, which method will likely yield higher results.

The standard mileage method is great because is very easy to track and takes no time at all thanks to great smart phone apps like MileIQ.

At the end of the year, you’ll compile all of your car expense documentation and report it on page 2, Part V of IRS Form 4562. The total expense will then flow to IRS Schedule E as an Auto Expense.

Putting it All Together

If you stuck with me through that entire article, give yourself a huge pat on the back. You now have the fundamental knowledge required to look at an IRS Schedule E and understand what is going on.

We talked about what IRS Schedule E is and how it interacts with the rest of your return. On a high level, we went over what costs go into your rental property cost basis and what you need to do to calculate depreciation (see our Cost Basis and Depreciation Calculator here).

We walked through IRS Schedule E and each expense line item and even talked about car expenses.

If you’re hungry for more or looking for a deeper dive, check out the articles referenced throughout this post. If you want to know more about something, contact us at contact @ therealestatecpa.com and throw in a suggestion for a topic. I’d love to hear from you!

If that was too complicated, let us take your taxes off your hands.

Drop us a line today for a free quote!