Real Estate Professional Status for Landlords:

The Ultimate Guide to Tax Planning For Landlords and Buy & Hold Real Estate Investors

Enter Your Email to Download the Guide and get 7 days of Tax Strategies Delivered to Your Inbox

This page is about giving landlords all the tools and knowledge they need to reduce taxes. Investing in real estate is an excellent way to reduce your effective tax rate. But taxes are complex and knowing what strategies to pursue can be challenging. Let this page be your resource to lower your tax bill. This page will link out to other content we have created or trust to take deeper dives into certain topics. Our goal is to provide you with a comprehensive guide that you can refer back to in the future! We hope you enjoy!

How the U.S. Tax System Works

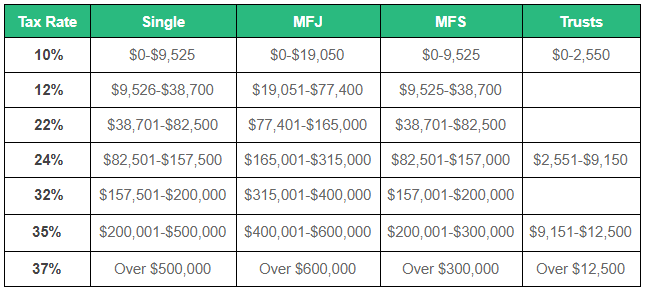

The U.S. Tax System is a progressive tax system. This means that the tax you pay on each dollar of earnings will increase as your income moves above each tax bracket per your filing status. Your marginal tax rate is better known as the current tax bracket you are in. The word “marginal” simply means that each additional dollar of earnings will be taxed at your corresponding tax bracket.

To illustrate how the progressive tax system and marginal tax rates work, let’s look at an example:

Let's assume your earnings will place you in the 24% tax bracket for 2019. In this case, not all of your earnings are taxed a rate of 24%. For married taxpayers, the first $19,400 of earnings are only taxed at a 10% rate. The next $59,550 of earnings are taxed at a 12% rate, and so on. It’s important to note that your earnings are not taxed at a flat rate equal to your marginal rate; rather the tax scales up as your earnings increase.

The ultimate goal of this page is to educate you on strategies that you can use to decrease your effective tax rate. Your effective tax rate measures the tax you actually pay on your total earnings. Quite often, rental real estate will produce positive cash flow but negative taxable income. This means that you receive income that you are not paying tax on, in the current year, which ultimately reduces your effective tax rate.

How Rental Real Estate Income is Taxed

There are three types of income:

- Earned (W-2 job or a business),

- Passive (rentals), and;

- Portfolio (stocks and bonds).

Owners of rental real estate enjoy tax benefits that regular W-2 wage earners and business owners do not. For starters, rental income is considered passive income unless you qualify as a real estate professional and materially participate in your rental activities. Passive income, unlike earned income, is not subject to FICA tax. FICA tax is also known as self-employment tax and is made up of Social Security tax (12.4%) and Medicare tax (2.9%) totaling 15.3%.

W-2 earners pay one-half of the 15.3% FICA tax and their employers pay the other half. But people who are self-employed and have earned income pay the full 15.3% FICA tax plus their marginal tax rate. Talk about a huge tax hit!

Aside from avoiding FICA tax, rental real estate often produces positive cash flow while simultaneously resulting in a net loss for tax purposes. This is best illustrated by an example:

Kal Drogo buys a rental property for $150,000 (value split: building = $127,500; land = $22,500) that produces gross rents of $18,000 for the year. His operating expenses (property management and professional fees, maintenance and repairs) amount to $7,000. Additionally, his mortgage payments amount to $8,000. Of the $8,000 of mortgage payment, the interest, insurance, and taxes are $7,000. This leaves $1,000 of principal which is not deductible for tax purposes because principal payments are treated like moving your money from one bank account to another.

The actual cash flow Mr. Drogo receives is $3,000 calculated as $18,000 of cash in (rental income) less $15,000 of cash out (operating expenses and mortgage payments).

Yet the net taxable loss is $636 for tax reporting purposes once we factor in annual depreciation calculated as follows: $18,000 gross rents - $7,000 operating expenses - $7,000 of interest - $4,636 depreciation. Remember, principal is not factored in for tax purposes as it's a non-deductible expense.

To summarize, Kal Drogo received cold hard cash of $3,000. But he gets to tell the IRS and state that he actually lost money on this rental, specifically in the amount of $636.

This is why owning rentals is powerful for your tax position. If you earn $200,000 and pay $50,000 in federal and state taxes, your effective tax rate is 25%. If you add a property like Kal Drogo’s, you now have $203,000 in total income but you reported a loss for tax purposes meaning your tax bill of $50,000 doesn’t increase and most likely stays the same (more on that later). Now your effective tax rate is 24.6%.

And if you can buy 10 properties like Kal Drogo, you’ll have $230,000 in income and still pay your same $50,000 of taxes resulting in an effective tax rate of 21.7%. That’s the power of investing in rental real estate.

Real Estate Investor vs. Business Owner and Why it Matters

When you invest in real estate, your level of activity will dictate whether you are an investor or a business owner. This distinction matters as if affects the deductions you can take and how passive losses from your rental real estate will ultimately affect you.

You are considered an investor in your rental activity if you are not actively participating in management decisions. Investors are generally those investing in real estate syndicates and funds as limited partners. Limited partners typically don’t have voting rights nor do they make management decisions and their level of participation in the activity is usually non-existent.

On the other hand, business owners work on their businesses regularly, systematically, and continuously in an effort to earn a profit. You do not have to do the work yourself, meaning you can hire a property manager and be relatively passive in your business yet still qualify as a business owner.

Business owners can deduct business expenses whereas investors cannot. If you want to maximize your tax deductions, you will want to actively participate and make management decisions for your real estate activities.

Short-Term vs. Long-Term Rentals

Many landlords and buy and hold real estate investors have jumped, enthusiastically, into the short-term rental space. They will buy property, fix it up, furnish it, and then attempt to rent it out on a short-term basis using a variety of advertising tools. The big question many landlords have is how to report their short-term rentals: on Schedule C or on Schedule E?

Short-term rentals are those with an average rental period of less than 30 days. Long-term rentals are those with an average rental period of more than 30 days.

Our position is that unless you are providing substantial services to your guests, your rental will not be reported on Schedule C regardless of how short the rental period is. Instead, you will report your rental on Schedule E similar to your long-term rentals, though you may want to read up on the transient use of rental property.

If, however, you are providing substantial services to guests, then your short-term rental may be reported on Schedule C. You then have to engage in further analysis to determine how much, if any, of your business's net income is subject to self-employment tax.

Reporting long-term rentals is much simpler; simply report on IRS Schedule E and any depreciation information on Form 4562 and you're all set!

Deductible Business Expenses for Your Rental Real Estate

Assuming your participation in your activities is greater than that of an “investor,” you will be able to deduct business expenses associated with the operation of your rental activity. Deductible business expenses must met the following tests:

- The expense is ordinary and necessary. Guard dog's may be necessary, but probably not ordinary.

- The expense is current. It provides a benefit now (i.e. advertising), rather than a longer-term benefit (i.e. a new roof).

- The expense is directly related to your real estate activity. Self-explanatory. The cost of your vacation and travel won't be deductible unless you can prove it's directly related to your real estate portfolio.

- The expense is reasonable in the amount. Do you really need to incur that $500 meal?

Our clients often ask us to provide them with a list of business expenses that they can take. Unfortunately, this is nearly impossible to do as there are so many iterations and variables. Here's a list of common expenses we see:

- Auto and travel,

- cleaning and maintenance,

- advertising,

- management fees and commissions,

- professional fees,

- insurance,

- property taxes,

- interest,

- repairs,

- supplies,

- utilities, and

- depreciation and amortization.

The deductibility of business expenses will also be dependent on when your business is placed into service. Costs incurred prior to the placed-in-service date are generally capitalized and depreciated whereas costs incurred after the placed-in-service date may be deductible in full in the current year. In general, the placed in service date for rental properties will be when the properties are ready for full operational use and when you have offered it to the public for rent. However, that's not always the case as you can learn more about here.

From a risk factor, we implore you to carefully deduct travel and transportation costs as well as costs associated with education and events. These costs are often challenged under IRS audit, so be careful when deducting these costs and make sure you can substantiate them.

Lastly, landlords often worry about deducting costs associated with a home office. But if your activity rises above "investor" status as previously discussed, your home office costs will qualify as business expenses. The IRS even released safe harbor to make it easier for anyone with an established home office to calculate the home office deduction. As long as your home office is regularly and exclusively used as the principal place of business, and you use the office as a place to meet with patients, clients, or customers in the normal course of business, your office will be deductible.

What is Rental Property Depreciation and Amortization?

Rental Property depreciation is one of the biggest and most important deductions for landlords and buy and hold real estate investors because it reduces taxable income but not cash flow. As a result, depreciation is often referred to as a "phantom" expense.

Every asset that is used in business has a useful life of which its cost must be depreciated over. Residential rental property has a 27.5 year useful life while commercial property has a useful life of 39 years. So if you buy residential rental property, you'd slowly deduct the cost of the building over a period of 27.5 years.

Notice how we said the "cost of the building" above. When you purchase a rental property, you must allocate the purchase price among the property's building and land. Land is not depreciated, thus any value allocated to land is not deductible via depreciation. But you would be able to deduct, via depreciation, the value associated with the building over 27.5 years.

There are two critical points to understand about depreciation:

- It is mandated by the IRS that you take it; and

- You don't have to "come out of pocket" each year to claim your depreciation expense.

On the first point above, many landlords and buy and hold real estate investors don't want to take depreciation due to the depreciation recapture tax imposed upon liquidation of the rental real estate. However, the IRS will impose the tax on the depreciation that you have taken or the depreciation that you should have taken even if you didn't take depreciation. You are required to take depreciation as a landlord. No ifs ands or buts about it.

On the second point, understand that depreciation is meant to track the property's deterioration over time. Because you paid for the property upfront, you will receive a nice tax deduction each year that you don't have to continually expend money to claim. Think of it as a nice "thank you for providing housing" from the IRS.

Amortization works similar to depreciation but is used to track the intangible costs of acquiring property, such as loan costs. Loan costs are any costs incurred to obtain the loan and the amortization period will be equal to the loan's amortization period.

Calculating Building and Land Values

When you purchase rental property, only a portion of the property's cost can be depreciated. Specifically, the value allocated to land cannot be depreciated. Of course, this means that each time a landlord or buy and hold real estate investor purchases a new property, they must calculate the building and land values.

Luckily, this isn't too difficult to do. To calculate the building and land value, the simplest method is to calculate the "improvement ratio" by examining the property tax card from the assessor database. We go over exactly how to do that here.

Without going through the steps required to calculate the building and land value, you'll make the rookie mistake of reporting the full purchase price as the building's basis. And don't just come up with a random percentage to allocate your building and land values by. We see many landlords make the mistake of allocating 15% or 20% of the purchase price to land. This could land you in hot water in expensive markets such as San Francisco or New York City because you'd be allocating too much value to the building and, as a result, your annual depreciation expense will be much higher than it should be.

Cost Segregation Studies and Why You Should Use Them

A cost segregation study is the act of allocating the cost of a property among the property's various components that make up the property. The benefit that cost segregation studies provide for landlords and buy and hold real estate investors is that they allow you to depreciate your properties over accelerated schedules.

Normally, landlords will depreciate the cost of rental property over 27.5 years and commercial property over 39 years. However, landlords that have a cost segregation study performed on their rental real estate will be able to allocate the cost between 5, 7, 15, and 27.5 year property. This means that the costs allocated to 5 year property are depreciated over 5 years instead of 27.5 years, 7 year property is depreciated over 7 years and so on.

Cost segregation studies often result in allocating 20-30% of the purchase price to 5, 7, and 15 year property. This can result in a huge boost of annual depreciation expense as illustrated below:

A rental property with a value of $500,000 will typically have $18,181 in annual depreciation ($500,000/27.5). However, if you were to perform a cost segregation study, you may break that $500,000 down in the following manner:

- 5-year property = $60,000

- 15-year property = $40,000

- 27.5-year property = $400,000

This value allocation will result in first year depreciation of $42,565 (200% declining balance for 5-year and 150% declining balance for 15-year; don't worry about understanding what that means). That's a $24,384 increase over our first year depreciation without a cost segregation study.

We most often see multi-family and commercial property landlords use cost segregation studies to boost depreciation. Single-family homes tend to not yield great results due to there being a lack of personal property and land improvements to allocate value to (i.e. one set of appliances versus ten sets of appliances in a 10-unit property).

Cost segregation studies are powerful, especially combined with 100% bonus depreciation and qualifying as a real estate professional. We've seen landlords and buy and hold real estate investors wipe out their tax bills by strategically utilizing cost segregation studies. But be mindful of depreciation recapture upon the liquidation of your property especially if you had a cost segregation study performed on it. You might be in for a rude surprise (also known as a big tax bill). That said, the time value of money on the increased cash flow due to the tax savings a cost segregation study can provide you generally outweigh any lingering concerns about the benefits.

Cost segregation studies are complicated and you should not try to complete one all by yourself. Make sure to loop in a professional if you'd like to have a cost segregation study performed.

100% Bonus Depreciation and Why it Matters

Under the Tax Cuts and Jobs Act of 2017, bonus depreciation for property with a useful life of less than 20 years increased to 100%. This means that in any year you place property into service that has a useful life of less than 20 years, you can immediately expense the full cost.

Pairing 100% bonus depreciation with cost segregation studies yields powerful tax deductions. In the prior section, we worked through a simple example of how a cost segregation study could increase first year depreciation by $24,384. However if we would have applied bonus depreciation to the 5-year and 15-year property, our first year depreciation deduction would be $114,545! That's due to being able to immediately and fully expense the value allocated to 5-year and 15-year property.

We have seen landlords and buy and hold real estate investors wipe out their tax bill by combining cost segregation studies, 100% bonus depreciation, and the real estate professional status.

Property that commonly qualifies for 100% bonus depreciation is:

- Appliances

- Carpeting

- Tools

- Equipment

- Computers

- Software; and

- Land improvements.

All good things are not without consequence, however. Read up on depreciation recapture and how that may affect your decision to take bonus depreciation.

Is Your Expenditure a Repair or Improvement?

After a property is in service, you’ll need to determine whether each repair and maintenance or renovation expenditure you incur should be classified as a regular expense or a capital improvement. Capital improvements are depreciated over the life of the capitalized asset, unless you can apply 100% bonus depreciation. Most landlords and buy and hold real estate investors will prefer to classify these costs as regular repair and maintenance expenses in order to maximize current year deductions and minimize depreciation recapture.

Repairs and maintenance are generally one time expenses that are incurred to keep your property habitable. To give you an idea of costs that qualify as repairs, we've listed common examples below:

- Painting

- Fixing an AC unit or leaky plumbing

- Patching holes in the wall

- Replacing a small part of the flooring or roof

- Replacing cabinet doors

- Repairing appliances

- Inspection costs

- Replacing broken parts

A capital improvement is expenditure that increases a property’s value, useful life, or adapts it (or a component of the property) to new uses. These items fall under categories sometimes called betterments, restorations, and adaptations. Examples that constitute capital improvements include:

- Full blown additions (e.g. additional room, deck, pool, etc.)

- Renovating an entire room (e.g. kitchen)

- Installing central air conditioning, new plumbing system, etc.

- Replacing 30% or more of a building component (i.e. roof, windows, floors, electrical system, HVAC, etc.)

Determining whether your expenditure is a repair or improvement is not as straightforward as it may seem. First, you need to identify the Unit of Property that the expenditure affects. There are nine Units of Property: the building structure, HVAC systems, plumbing systems, electrical system, escalators, elevators, fire-protection and alarm systems, security systems, and gas distribution systems.

You must then apply the De Minimis Safe Harbor, the Routine Maintenance Safe Harbor, and the Safe Harbor for Small Taxpayers. If your expenditure fails all of the tests associated with those three safe harbors, you will move on to the Betterment, Adaption, Restoration tests. After working your way through these safe harbors and tests, you'll know whether your expenditure qualifies as a repair or is considered a capital improvements that must be depreciated.

Below is a high level overview of the Betterment, Adaption, Restoration tests.

An expenditure will fall under a Betterment if it ameliorates a “material condition or defect” in the UOP that existed before it was acquired, it is for a “material addition” to the UOP, it materially increases the size or capacity of the UOP, or materially increases the productivity, efficiency, or strength of the UOP. “Material” in the case of Betterments generally means 30%, though there is no bright-line test. Thus, if you buy a 10 unit apartment complex and replace 2 HVAC units, you will have replaced 20% of the HVAC system. While the HVAC replacements will be too expensive for any of the three safe harbors previously discussed, they do not materially improve the UOP and therefore can be deducted.

An expenditure will be a Restoration if it replaces a major component or substantial structural part of a UOP or rebuilds the UOP to like-new condition. As with the Materiality threshold for Betterments, we aim for 30% when attempting to define “major” or “substantial” however the Regulations make no mention of a numerical threshold.

An expenditure is an Adaptation if a UOP is modified to serve a new and different use no consistent with the original ordinary use.

Three Safe Harbors Every Landlord Should Know

As discussed in the above section, there are three safe harbors related to repairs and maintenance that every landlord and buy and hold real estate investor should know. Those three safe harbors are:

- The De Minimis Safe Harbor

- The Routine Maintenance Safe Harbor

- The Safe Harbor for Small Taxpayers

The De Minimis Safe Harbor is found under Reg. Sec. 1.263(a)-1(f). Landlords may use the De Minimis Safe Harbor to deduct up to $2,500 of the costs of tangible property used to produce or acquire rental real estate. This deduction limit is applied at the “invoice” level. Such tangible property includes materials and supplies as well as installation (labor) costs. The safe harbor does not apply to materials and supplies for use in manufacturing inventory; thus if you were to flip property, you cannot use the DMSH.

There is an anti-abuse rule which does not allow you to manipulate a transaction to ensure all costs related to the tangible property fall below the $2,500 threshold. For example, if an HVAC unit costs $4,000 for parts and labor, you cannot divide up the costs as the property must be looked at in the aggregate.

The Routine Maintenance Safe Harbor is found under Reg. Sec. 1.263(a)-3(i). There is no limit on the amount you can deduct under this safe harbor.

Routine Maintenance is work the landlord performs on a property to keep the building and each of the building’s systems in operating condition. This generally includes inspecting and cleaning components of the building or structure and then replacing the damaged or worn parts.

In order for costs to count under the Routine Maintenance Safe Harbor, you must reasonably expect to perform such maintenance more than once every ten years (i.e. replacing carpet every 4-5 years). This rule eliminates the replacement of larger components, such as roofs, windows, and tile/wood flooring. Landlords may not deduct costs under the Routine Maintenance Safe Harbor that qualify as Betterments or Restorations. Thus, major repairs and remodeling will not qualify, however defects discovered during routine inspections will qualify.

Found in Reg. Sec. 1.263(a)-3h, the Safe Harbor for Small Landlords allows real estate investors to deduct all of their repairs and maintenance on a property as long as the property’s unadjusted basis is less than $1MM and the total aggregate cost of the repairs, maintenance, and improvements for that property during the year were less than $10,000 or 2% of the unadjusted basis on the building, whichever is less.

This safe harbor is generally claimed in years in which properties did not incur large repair or maintenance expenses but did inclur a large capital expenditure.

For example, assume you own a property with an unadjusted basis of $300,000. This property required $0 of repair and maintenance during the year but did require a replacement HVAC costing $4,000. Because 2% of $300,000 is $6,000 and that is less than $10,000, $6,000 is the threshold that, if we stay under, we can deduct the cost of the HVAC in full. Because the HVAC cost only $4,000, and because our other maintenance and repairs were $0, we can fully deduct the cost of the new HVAC.

Can You Deduct the Losses Your Rentals Create?

As a rental property owner it’s not uncommon for your properties to produce a net loss for tax purposes thanks to depreciation and other operating expenses. The treatment of these losses is often misunderstood by landlords for various reasons, so we’ll spend some time here to clear up common misconceptions.

Losses from rental property are considered passive losses and can generally only offset passive income (i.e. income from other rental properties or another business in which you do not materially participate, not including investments). If these passive losses exceed your passive income, they are suspended and carried forward indefinitely until future years, when you either have passive income or sell a property at a gain.

However, if you actively participate in your rental activity, and make management decisions, then under the passive activity limits you can deduct up to $25,000 in passive losses against your ordinary income (e.g. W-2 wages) as long as your modified adjusted gross income (MAGI) is $100,000 or less. This deduction begins to be phased out by $1 for every $2 of MAGI above $100,000 until your MAGI hits $150,000, at which point the deduction is completely phased out.

If you're MAGI is above $150,000, the passive losses generated from your rental real estate will become suspended and carried forward. However, not all is lost as there are strategies to tap into suspended passive losses. Of course, to avoid this altogether you or your spouse can qualify as a real estate professional.

A quick note: many of our high net worth clients assume that rental real estate is not helping them if they cannot claim the losses. This is far from the truth. What these landlords fail to realize is that, while the have suspended passive losses that they are carrying forward, they also received cash flow from the rental real estate that they didn't pay tax on. This results in a reduction of the landlord's effective tax rate.

The Power of Qualifying as a Real Estate Professional

One of the greatest advantages to owning real estate rentals for high-income earners is the “Real Estate Professional” status. Qualifying as a real estate professional, and also demonstrating material participation in your rental activities, will allow landlords to fully deduct the losses created from their rentals against their (or their spouse's) ordinary income. When landlords and buy and hold real estate investors combine the real estate professional status with cost segregation studies and 100% bonus depreciation, they can effectively eliminate their, or their spouses, ordinary income resulting in a very low or $0 tax bill.

Two quick points about the real estate professional status that we want you to ingrain into your brain:

- You absolutely, 100%, do not need a real estate salesperson license to qualify as a real estate professional. The real estate professional designation is based on hours spent in IRS mandated activities and has nothing to do with being a real estate agent.

- You absolutely do need to understand that qualifying as a real estate professional is only the first step to claiming an unlimited amount of passive losses. The second step is demonstrating material participation in your rental real estate activity. Without material participation, you won't be able to claim your losses!

To qualify as a real estate professional, you or your spouse must work 750 hours in a real estate trade or business and more than half of your working hours need to be dedicated to your real estate trade or business. A real estate trade or business can be real estate sales, development, leasing, and construction, or managing a rental portfolio.

There are seven tests to demonstrate material participation, however the most common tests we see used are spending more than 500 hours on your rental real estate activity or 100 hours and more than anyone else.

A key issue is that you must materially participate in each rental real estate activity separately unless you group them together as one activity under IRC Sec 1.469-9. When you make an election to group your rental real estate activities into one activity, you must only materially participate in the one activity. Be careful with this election as it can certainly result in unforeseen issues.

If you or your spouse qualify as a real estate professional, and if you demonstrate material participation, your rental real estate losses will be considered non-passive and can be used to offset other non-passive income. To show how hard-hitting this is, let's assume your spouse makes $300,000 at her W-2 job and you are investing in real estate full-time. You qualify as a real estate professional and materially participate in your rental real estate activities. You decide to buy a $1MM apartment building and, after running a cost segregation study, you are able to allocate 30% of the purchase price to 5, 7, and 15 year property. This means that you can use 100% bonus depreciation on this property effectively providing you with a $300,000 first-year depreciation deduction. That will most certainly create a large loss that you will be able to use to drastically offset your spouse's W-2 income.

How to Tap Into Suspended Passive Losses

Understanding how to tap into your suspended passive losses is important for all landlords and buy and hold real estate investors to understand. At some point, you'll likely be faced with the dreaded suspended passive loss. Your income will be too high and your real estate will be spitting out taxable losses thanks to all of the other awesome strategies you are using. If you are unaware as to how you can tap into suspended passive losses, then you'll leave a ton of money on the table.

We helped a client that came to us with $500,000 in suspended passive losses. $500,000! That means this real estate investor could have earned $500,000 of passive income without paying a dime in tax. Don't let your suspended passive losses get that high unless you are doing it on purpose to create flexibility.

Here are a few quick-hitting ideas to tap into your suspended passive losses:

- Acquire property that provides for better cash flow

- Sell property that has appreciated in value

- Qualify as a real estate professional (though this only stops future suspended passive losses from accruing; qualifying as a real estate professional will not allow you to unlock prior suspended passive losses)

- Invest in Passive Income Generators (PIGs) such as income oriented real estate limited partnerships or oil and gas investments. PIGs are are business investments in which you do not materially participate that are generating passive income from the beginning of your investment.

Managing your suspended passive losses effectively will allow you to optimize your cash flow and tax position. Don't let your suspended passive losses build up too much without taking any action.

If you want to track your suspended passive losses, pull up your tax return and scroll to Form 8582.

Ready to take your tax strategy to the next level? Click the link below to schedule a free 30-minute consultation where we'll determine if we can help you save more money.

The New 20% Pass-through Deduction

One of the major benefits for business owners in the 2017 Tax Cuts & Jobs Act is the pass-through business income deduction. Business owners that are sole proprietors, LLCs, and S-Corps with taxable income less than $157,500 ($315,000 if MFJ) will be able to deduct 20% of their qualified business income. For example, if you have a business with net operating income of $100,000 and W-2 wages of $50,000, you will be able to deduct $20,000 from your net operating income ($100,000 x 20%).

For taxpayers with taxable incomes above these thresholds ($157,500 if single, $315,000 if married filing joint), things get a little more complicated as W-2 wage limitations come into play, and for service businesses (i.e. wholesalers, law firms, accountants, etc) this deduction is phased out between $157,500 - $207,500 for single taxpayers and $315,000 - $415,000 for married taxpayers.

Real estate investors and landlords need to understand how these new rules apply to rental real estate. The problem with rental real estate is that the taxable income is most often negative due to depreciation and amortization. In such cases, this will actually reduce the qualified business income you have available for the 20% pass-through deduction. If you invest in real estate syndicates or funds, you should also be aware of how the elections they make at the fund level affect your ability to claim or not claim the 20% pass-through deduction on your own returns.

A major issue for landlords and buy and hold investors is whether their rental real estate activities rise to the level of a trade or business. Without rising to such a level, your rentals will not produce qualified business income. The challenge rests with whether a rental activity rises to the level of a trade or business under IRC Sec 162.

To make this analysis simpler, the IRS produced a safe harbor for landlords in January 2019. This safe harbor is detailed under Rev. Proc. 2019-7 and detailed how landlords can qualify their activities as a Sec 162 trade or business and qualify for the 20% pass-through deduction as a result.

Shifting Income by Paying Your Children

Wages paid to your children count as a tax deduction for you and in most cases the child will not have to report the income as long as the payment amount was less than the child's standard deduction. This allows you to effectively create family wealth out of thin air because you're moving money into your child's pocket, you receive tax savings, and your child doesn't have to report the income.

Let's look at an example with numbers:

Your child, John Snow, helps you with various activities to maintain your rentals. Little John travels with you to the properties during the week and on the weekends and performs tasks appropriate for his age. You pay John $10,000 during the year to compensate John for his services. This $10,000 payment is a deduction for you, and because you happen to be in the 24% marginal tax bracket, you end up saving $2,400 as a result. The best part though is that John's standard deduction is $12,000 and because his wages don't exceed that amount, John doesn't even have to file a tax return. Thus, by paying John $10,000, you have created family wealth equal to your tax savings. John keeps his $10,000 and you reduce your tax bill by $2,400.

There are several rules and processes you must follow in order to pull this off. On a high level, you need to be aware of the Fair Labor Standards Act. Your child must also be an employee, there must be a job description, the compensation must be reasonable, and complying with legal requirements for employers by filling out Forms W-4 and I-9. You also need to be cognizant of local tax laws and how to use family management companies to get around payroll taxes on the W-2 wages you pay your child.

The compensation being reasonable is always the big discussion point with landlords. Compensation is largely going to depend on the tasks that the child is responsible for and what you would reasonable expect to pay for such services should you hire someone else to complete them for you. Don't think you can get away with paying a young child thousands of dollars without solid support!

Using Retirement Accounts to Invest in Real Estate

Retirement plan assets can be invested in private real estate holdings, syndicates, or funds. In order to place such investments, investors will need to have the ability to self-direct the retirement plan's assets. The most common self-directed accounts are called a Self-Directed IRA and Solo 401(k). Each plan comes with separate rules that you must be aware of prior to pulling the trigger on any investment.

Many of our clients use their self-directed accounts to invest in rental properties and real estate syndicates. We like to see self-directed retirement account owners invest in real estate notes or real estate funds that produce interest income. The reasoning behind this is that interest income is tough to shelter but an excellent, and dependable, income stream. So if you take the interest income into your retirement account by investing the account assets into real estate notes or debt funds, you get the best of both worlds: a great, tax-deferred, income stream.

If you use your retirement account to invest in assets that are debt levered, like most real estate syndicates and funds, or if you invest in a business, you need to be aware of how Unrelated Debt-Finance Income (UDFI) and Unrelated Business Taxable Income (UBTI) will affect your returns. Many investors are unaware that they may owe tax on the income flowing back into their retirement accounts. To make matters worse, many real estate syndicates and funds (and their CPAs!) are unaware of reporting requirements related to UDFI and UBTI which increases the risk that the investor will fail to file and pay the appropriate returns and tax. You also need to be aware of prohibited transactions and disqualified parties.

Why would someone want to use their retirement accounts to invest in real estate? Usually, investors feel that they can earn a higher return on investment by placing the funds into private real estate deals. But the biggest benefit is that the profits flowing back into the retirement account avoid taxation allowing the investor to continually re-invest and grow their wealth.

Investing in Real Estate Syndicates

A real estate syndicate, in the simplest form, is a group of investors that get together to pool their money and purchase a large asset. Generally speaking, the assets are large enough that the investors cannot buy them on their own, hence the reason for partnering up with other investors.

A typical syndicate structure involves an LLC for the property that is owned by limited partners and general partners. The limited partners typically take an ownership stake in the LLC based on their initial investment. The general partners are granted a stake in the LLC because they did all the hard work of putting the deal together and they will be operating the property during the hold period. We've seen some general partners put their own cash into their deals, however most don't.

As a landlord or buy and hold real estate investor, you may be wondering why we'd include investing in real estate syndicates on this resource page. The reasoning is that this can be a key strategy for you to invest as a limited partner and create a very passive income stream. Though you need to make darn sure you know what you're getting into and who you're investing with.

You can also use these limited partner investments to claim tax losses. Most syndicates run cost segregation studies which means the limited partners will all receive large passive losses during the first few years of ownership. If you structure your facts correctly, you'll be able to fully claim the passive losses that the syndicate passes to you. Please note, however, that this can get quite complicated. Don't start investing in syndicates "willy nilly" or the passive losses the syndicate passes to you will be suspended and you'll be disappointed.

Exit Strategies When Liquidating Rental Real Estate

At some point you may wish to liquidate your rental real estate. Whether it's one property or your entire portfolio, landlords and buy and hold real estate investors need to be aware of the exit strategies available to them. These exit strategies will help you avoid tax on the gain resulting from the sale of your rentals.

The most common exit strategies are:

- Selling outright, especially if you have a large amount of suspended passive losses

- 1031 Exchanges

- Rolling gains into a Qualified Opportunity Fund

- Buying a new property and running a cost segregation study which will create a large passive loss

- Refinancing, just be careful with the debt tracing rules, and yes your business interest is still deductible

- Dying (of course, we don't want anyone to die, but when you die your beneficiaries will receive a stepped up basis and won't pay tax on sale making dying a great exit strategy for real estate investors. But be careful, you can definitely mess up the stepped-up basis treatment.)

There are many more exit strategies that largely depend on your personal facts and circumstances. For example, if you are a charitable person, you may wish to move the property into a Charitable Remainder Trust. Or if you are turning your primary residence into a rental, you may wish to "sell" it to an S-Corporation you own to capture the IRC Sec 121 benefits and receive a stepped up basis.

The key to understand here is that if you own real estate, and you want to liquidate the real estate, there are plenty of ways to avoid paying tax on the gain from sale. Plan on using these exit strategies from the get-go and you'll build tax-free wealth!

Investing in Opportunity Funds

Investing in a Qualified Opportunity Fund provides investors with flexibility and several tax benefits. You have to be okay with the long hold periods for your investment though.

Opportunity Zones were introduced by the Investing in Opportunity Act which was part of The Tax Cuts & Jobs Act passed in late 2017. They are economically-distressed communities nominated by the state governments and certified by the Secretary of the U.S. Treasury. A full list of current Opportunity Zones can be found on the CDFI Fund website.

Opportunity Funds are investment vehicles organized as a corporation or a partnership to invest in Opportunity Zones and hold 90% or more of its assets in Opportunity Zone assets. These funds allow investors to pool their capital together and help revitalize Opportunity Zones through new business and projects. In exchange, investors receive favorable capital gains tax treatment on the sale of their capital assets.

Investors only need to invest the capital gain portion from the proceeds of the sale of their current assets in an Qualified Opportunity Fund in order benefit. This allows investors to receive their basis upon liquidation of an asset while only rolling their capital gain into the opportunity fund. Compare that to a 1031 exchange where you must generally roll all of your proceeds from the sale of an asset into the replacement asset. The capital gain portion of the proceeds from the sale of an asset must be reinvested into an Qualified Opportunity Fund within 180 days from the date of sale.

Basis Step-Up: Investors who invest in Qualified Opportunity funds will receive a step-up in their investment basis if they hold the investment for a certain number of years. Initially, the basis step-up is zero. But if the investor holds for five years, they will receive a basis step-up of 10%. If the investor holds for seven years, they will receive an additional 5% of basis step-up. As a result, if an investor holds a Qualified Opportunity Fund investment for a period of seven years or more, they will reduce the originally taxable portion of their capital gain by 15%. However, all investors must recognize their gain on their original investment and pay tax on that gain in 2026. This gives you until December 31, 2019 to invest into a Qualified Opportunity Fund in order to allow the full seven years to elapse before 2026 rolls around. If you invest after this date, you won't benefit from the seven year basis step-up because a full seven years will not have elapsed by the end of 2026.

Eliminating Capital Gains: If an investor holds their Qualified Opportunity Fund investment for a period of 10 years or greater, the investor will not recognize capital gain on the appreciation of their investment during the hold period.

For example, let's assume you invest $100,000 of capital gain into a Qualified Opportunity Fund. In the year that you make the investment, you pay no tax because a Qualified Opportunity Fund allows you to defer recognition of your capital gain. When 2026 rolls around, you have been holding your investment for a full seven years so you must recognize and pay tax on an $85,000 gain (15% less your original gain). The remaining $15,000 is tax-free. You decide to hold for another three years to benefit from the ten year rule. In 2029, you liquidate your stake in the Qualified Opportunity Fund and receive a total of $210,000 (your original $100,000 investment plus $110,000 of appreciation). Because you held for ten years, you will not pay a cent in tax on the $110,000 of appreciation.

We have written more extensively on Opportunity Funds and you can also snag our white paper on the subject here.

What Entities Should You Use When Investing in Rental Real Estate?

Let's clear one thing up: using entities for your rental real estate will rarely result in tax savings for you. However, using the wrong entity structure can most certainly create tax problems.

Many educational seminars and real estate gurus love explaining that setting up LLCs will yield tax benefits for landlords. Talking about entities is sexy and it's what all new landlords want more information on. Below we've provided quick-hitting tips on entity structuring:

- If you are pitched using LLCs to generate tax savings for your rentals, immediately question everything else that person is telling you. LLCs do not provide landlords with tax benefits

- Liability protection, when pertaining to your rentals, should be the primary goal

- Technically speaking, only licensed attorneys can set up LLCs for you, unless you do it yourself

- Never use S or C-Corporations to hold your rentals

- It's a good idea to hold real estate in LLCs, whether they be 100% owned by you or the ownership is split between you an partners

- Trusts can be helpful depending on the situation

We recommend keeping things simple unless your asset protection game needs to be stepped up a notch due to your net worth, holdings, and risk factors. At the same time, we always recommend talking to an attorney first. Yes, it may cost a bit more coin upfront, but a great attorney will make sure that the LLC you want to set up is (1) set up correctly and (2) accomplishes what you're trying to get out of entity structuring.

Many of our clients hold their rentals in simple LLC structures. They typically own the LLC outright, with a spouse, or with partners. Our clients will also utilize property management LLCs, series LLCs, and trusts depending on what they are trying to accomplish.

Reporting Your Rentals on Your Tax Return

After going through this resource, you should have better ideas on strategies you want to implement with your rental portfolio. It will be all for naught if you or your tax preparer fail to report your rentals on your tax return correctly.

Individual landlords report their rentals on IRS Schedule E. This is a supplemental schedule to IRS Form 1040. In order to report correctly on Schedule E, you'll need to calculate the property's building and land value and you'll need accurate accounting records so that you can report the property's income and expenses. We have an extensive article walking you through IRS Schedule E here.

If you are a partner in an LLC taxed as a partnership, you will file IRS Form 1065 and the rental properties will be reported on Form 8825 which is the Schedule E version for partnerships. Filing Form 1065 can get complex quickly and we don't recommend filing without a qualified professional.

You also need to be aware of the elections and statements that you may need to file depending on the facts and circumstances surrounding your rental activity. For example, qualifying as a real estate professional but failing to group your rental activities into one for material participation purposes can be detrimental to deducting your passive losses.

If you're unsure whether or not your tax professional has been filing your returns correctly in the past, CLICK HERE to fill out a webform for a consultation and free tax assessment. The majority of the tax returns that we review contain errors in them (and we can help you fix them!).

What You Need to Know About the Tax Cuts and Jobs Act of 2017

On 12/22/2017, President Donald Trump signed the much talked about Tax Cuts and Jobs Act into law.

This was a fast process for such a large bill. The Tax Reform Act of 1986 took two years to hash out differences and approve. Two years. Fast forward to 2017, in a short seven weeks the GOP has developed, amended, reconciled, and signed into law a $1.456 Trillion tax bill.

We’re here to talk about what’s in the bill and how if may affect you. This section is not meant to be all encompassing. Instead, we’re pointing out key changes that affect landlords and buy and hold real estate investors.

That’s crazy fast. Not to mention the final bill has over 1,000 pages of text. Regardless, we’re not here to talk about whether or not our elected officials have read the bill they approved.

Tax brackets have been modified as you can see (2019 brackets pictured)

Itemized deductions changed, the most significant part was reducing the State and Local Tax deduction limit to $10,000

Our clients in high property and income tax states got hammered by the changes in itemized deductions, the State and Local Tax deduction being the main culprit. With the new changes, property tax and state income tax deductions were limited to an aggregate of $10,000. Many of our clients deducted 5x that amount in the past and this one change resulted in an increase of tax for many Americans. There remains confusion in the investor community as to whether the State and Local Tax deduction limitation also applies to rental property, however that is not the case as property taxes associated with a rental property will be considered a business expense.

Mortgage interest is deductible on the first $750,000 of new acquisition debt on primary and secondary residences. Originally, the proposed limits were much lower so it’s nice to see that they walked it back.

Home equity debt now poses a problem unless you use the proceeds to purchase or improve rental properties or for business. Interest on home equity debt is no longer deductible. Home equity debt includes refinances on your primary or secondary residences as well as HELOCs.

You will no longer be able to claim miscellaneous itemized deductions, such as tax preparation fees and unreimbursed employee expenses. Though you can still allocate tax preparation fees to Schedule C and E.

The Standard Deduction increased but personal exemptions were eliminated

The standard deduction has almost doubled. Single taxpayers will now claim $12,000 and married taxpayers will claim $24,000. This will cause fewer taxpayers to itemize deductions.

Personal exemptions have been eliminated. Taxpayers were previously allowed to take a personal exemption deduction of $4,050 per person they claimed on the tax return.

A boost for the Child Tax Credit

Though personal exemptions have been eliminated, the new rules surrounding the child tax credit will help balance things out. The Child Tax Credit amount increased from $1,000 to $2,000 per qualifying child. The refundable credit increased to $1,400. The income phase outs have increased to $200,000 if single and $400,000 if married filing joint.

Use of 529 Plans expanded

529 plans received a much needed boost. You can now use 529 plans to pay for private, public, and religious elementary and secondary schooling and qualified education expenses.

Alternative Minimum Tax (AMT) is still lurking, but affects less taxpayers

The exemption amounts have increased to $109,400 for married filing joint and $70,300 for all other taxpayers. The phaseout thresholds are increased to $1,000,000 for married taxpayers filing a joint return, and $500,000 for all other taxpayers (other than estates and trusts). These amounts are indexed for inflation. And unfortunately that means tax professionals still have to stumble through the AMT calculation each year.

Obamacare penalty eliminated

Good news for folks who are young, healthy, and don’t want or need health insurance. Beginning in 2019, you will not be assessed a penalty for not having health insurance. Unfortunately it’s bad news for everyone else who wants or needs health insurance. With the expected reduction in people buying health plans beginning in 2019, premiums are anticipated to increase.

20% Pass-Through Deduction added

This gets complicated fast, but try to hang in there. This “freebie” deduction is huge for landlords and business owners as long as your activity rises to the level of a trade or business. The deduction is granted after the calculation of AGI, so it’s a “below the line” deduction.

The deduction is available for sole proprietors, LLCs, and S-Corps generating qualified business income. If you are a partner in a business, you will receive the deduction based on your allocable ownership.

Service businesses will not receive a deduction at all, unless the taxpayers who own the service businesses have taxable income less than the below thresholds. The GOP brought down the hammer when they defined a service business as "any trade or business where the principal asset is the reputation or skill" except for engineers and architects though additional service businesses were later excluded.

If your total taxable income is less than $157,500 if single or $315,000 if married filing joint, then you just get a 20% deduction on combined qualified business income. You don’t have to worry about the additional calculations with wages and unadjusted basis.

The IRS released a safe harbor to help landlords qualify their rental properties for the 20% pass-through deduction.

C-Corporation tax rates reduced to a flat 21%

A 21% tax rate is a huge boon for C-Corporations. If you have previously considered C-Corporations in your tax planning, now is the time to revisit! C-Corporations can siphon off profits from other businesses and your portfolio. If used correctly, you can see a great reduction in your overall tax liability. Of course, there are major pitfalls to avoid as well, so don't try this on your own.

Bonus Depreciation increased to 100%

If you place assets with useful lives of less than 20 years into service beginning September 29, 2017, the asset will qualify for 100% expensing through bonus depreciation. Notably, rental properties have a 27.5 year useful life but if you perform cost segregation studies you will be able to use 100% bonus depreciation on the value allocated to the components with a useful life of less than 20 years.

It's not all fun and game. When you sell the assets, you will pay depreciation recapture tax, so while you get a nice write-off upfront, you’ll have to pay it back some day.

Lifetime Gift Exclusion doubled

Good news for folks with large estates. The lifetime gift exclusion has increased from $5MM to $10MM per person. This means you can pass $10MM of wealth tax-free.

Gifts are often a misunderstood concept. In any given year, you can gift anyone $14,000 each without incurring any tax filing requirements. So ff you’re feeling generous, you can gift me $14,000, and each person on my team $14,000. Because you’re gifting each person $14,000 or less, you don’t have to file a gift tax return.

But if you gift me $20,000 in one year rather than $14,000, then you must file a gift tax return and report the $6,000 in gifts. The gift is not taxable until your lifetime gift exclusion of $5MM (now $10MM under the new bill) has been completely used up. The $6,000 in this example simply reduces your lifetime exclusion by $6,000.

The $10MM will be indexed for inflation and shelters many more estates from federal estate taxes.

Rehabilitation Tax Credit reduced in scope

The rehabilitation tax credit is now only available for certified historic structures. The 20% credit has been retained, however the 10% credit for pre-1936 buildings has been eliminated.

Section 179 is now more useful for commercial property owners

Section 179 allows you to write off the entire cost of certain property. The aggregate cost amount able to be expensed has increased to $1MM, up from $500k. Additionally owners of non-residential property can now use Section 179 for roofs, HVACs, fire systems, and security systems.

"Non-residential property" is commercial property and certain short-term rental property. So if you own a NNN property or an AirBnB property, you may qualify for immediate expensing of big time improvements.

1031 Exchanges now only allowed for real property

The good news is that real estate investors can still use 1031 exchanges. The bad news is that if you have had a cost segregation study performed on your property, you may be in trouble. When you have a cost segregation study performed on your property, you are attempting to assign value to IRC Sec 1245 property, otherwise known as personal property. So the question is, will owners of rental real estate who have engaged in cost segregation studies be able to 1031 exchange their entire property value or just the value associated with real property (not personal property)?

Though the Tax Cuts and Jobs Act removed personal property from qualifying for a 1031 exchange, Footnote 726 of the Committee Report stated “It is intended that real property eligible for like-kind exchange treatment under present law will continue to be eligible for like-kind exchange treatment under the provision.” As a result, we feel Congress intended that 1031 treatment for rental real estate under the law prior to the Tax Cuts and Jobs Act continue to apply.

Ready to take your tax strategy to the next level? Click the link below to schedule a free 30-minute consultation where we'll determine if we can help you save more money.

★★★★★

Hall CPA PLLC, real estate CPAs and advisors, helped me save $37,818 on taxes by recommending and assisting with a cost segregation study. With strategic multifamily rehab and the $2,500 de minimus safe harbor plus cost segregation, taxes on my real estate have been non-existent for a few years (and that includes offsetting large capital gains from the sale of property).

Mike Dymski - Business Owner