The marginal tax rate is the percentage of tax applied to your income per the IRS tax brackets. Your taxable income determines your marginal tax rate.

You marginal tax rate determines the rate in which your next dollar earned will be taxed. For example if you are single and your taxable income is $158,000, your next dollar will be taxed at 32%.

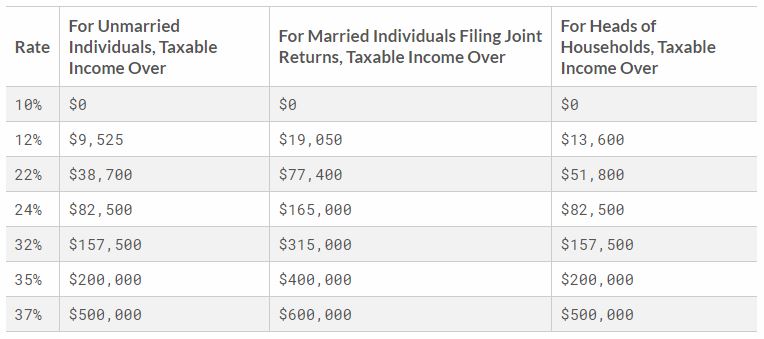

2018 tax tables can be seen below:

Have questions?

Our Tax Smart Investor Plus subscription includes Live Q&As where you can get your questions answered by our seasoned tax experts.