Table Of Contents

Are we at the top of the market?

No one knows for certain, but we are on the longest bull market in history. And at The Real Estate CPA, we believe we're closer to the top of the market than the bottom.

If you built up a large amount of equity over the last several years through appreciation and principal paydown, now might be a good time to offload some of those investments and lock in profits while it's still a seller's market. Especially the properties you don't want to hold for the next 5 years, or through a recession or downcycle.

Of course, the problem with selling properties is the dreaded capital gains tax. Luckily, you came across this article that discusses 6 exit strategies for rental real estate investors. And some can help reduce or defer your capital gains tax.

Traditional Sale

Ahh the traditional sale.

The traditional sale is the most common exit strategy for real estate investors. You simply sell the property and pay the capital gains tax on the difference between the sale price and adjusted basis of the property. Oh yeah, and depreciation recapture on the portion of the gain from accumulated depreciation.

As a reminder, the adjusted basis of a property is its purchase price + improvements - accumulated depreciation.

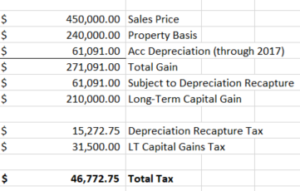

For example, you bought a property in 2011 for $200,000 and did $40,000 worth of improvements. Its now 2018 and you sell the property for $450,000. And your total accumulated depreciation from the last 7 years is $61,091. Your capital gain is as follows:

Ouch, $46,722.75 stings a little, doesn't it?

The obvious downside of a traditional sale is you have to pay the entire tax upfront, and it can potentially put you in a higher tax bracket if the gain is large enough.

But this doesn't mean a traditional sale doesn't have its advantages. It's definitely one of the more conservative options as you get the entire sales proceeds upfront, pay your taxes and keep the rest. Which is helpful if you need the cash right away for a major life or business purchase.

Opportunity Funds

Opportunity Funds are a new investment vehicle given to us by the TCJA of 2017. They allow you to roll over the capital gains from the sale of any capital asset within 180 days, and defer the capital gains tax until 12/31/26.

Investments held in Opportunity Funds for:

- 5 years receive a 10% basis increase in the original investment.

- 7 years receive an additional 5% basis increase, bringing the total basis increase to 15%.

- 10 years are exempt from tax on the gains from the investment in the Opportunity Fund

For example, you purchase $100,000 property in 2010. In 2019 you sell the property for $200,000 and roll over the $100,000 capital gain into an Opportunity Fund within 180 days. In 5 years, the basis in your original investment of $100,000 increases by 10% to $110,000, which reduces your capital gain by $10,000. And in 7 years your basis increases another 5% to $115,000, which reduces your capital gain by a total of $15,000. You hold the investment for 10 years. And during this time, your $100,000 investment in the Opportunity Fund appreciates to $150,000. Because you held the investment for 10 years the tax on your $50,000 gain from the Opportunity Fund investment is eliminated.

The upside of using Opportunity Funds is you can defer and reduce your capital gain on the sale of your rental property. And capital gain on the Opportunity Fund itself is exempt from tax if you hold your investment for 10 years. Also, unlike 1031 Exchanges, you don't have to roll over the entire sales proceeds, you just have to roll over the capital gain.

On the downside, you must roll over any capital gains you wish to defer by 12/31/19 to receive the full benefits of Opportunity Funds. Also, while you can invest more than just your capital gains, only your capital gains are eligible for these tax benefits.

1031 Exchange

If you don't need the cash today, you can defer your capital gains (and depreciation recapture) tax by rolling the entire sales proceeds from the property you sell, into another, usually larger, property. This is called a 1031 exchange.

For example, you purchase a property in 2012 for $250,000, by 2019 the property appreciates to $400,000 and you decide to sell. The capital gain from that sale is $150,000, and roughly $22,500 tax will have to be paid on that gain. If you didn't have to pay $22,500 in tax, you would have an additional $90,000 in purchasing power to buy your next property. This assumes you use a leverage with a standard 75% LTV ratio.

To properly complete a 1031 exchange you must:

- Identify up to 3 replacement properties within 45 from the date of sale; and

- Take ownership of the new property within 180 days of sale

The upside of doing a 1031 Exchange is you defer the capital gains tax and purchase a larger property. You can even use a Delaware Statutory Trust (DST) or TIC structure to receive fractional ownership of a much larger property if you're burned out from managing properties yourself.

On the downside, 1031 exchanges can sometimes be difficult to execute and leaves you with a reduced basis in the replacement property, which will lead to increased capital gains down the line. And of course, this won't help if you need the cash or are trying to exit real estate altogether.

Installment Sale

An installment sale, sometimes called seller/owner financing, allows you to sell your property to a buyer and receive payments over a predetermined number of years. This spreads out your capital gains tax over several years and gives you an additional return in the form of interest.

For example, you purchase a property in 2010 for $30,000 and want to sell for $110,000 in 2018. Your AGI is $180,000 and this $80,000 capital gain is about to increase your AGI to $260,000, causing you to pay an additional 3.8% net investment income tax. Your CPA suggests selling this property on an installment sale to avoid the 3.8% tax.

You find a buyer and sell them the property for $110,000. They put $10,000 down and finance the remaining $100,000 over a period of 10 years, plus 6% interest. Each year $7,273 out of the $10,000 payment is considered a capital gain and the other $2,727 is your return of principal. You'll pay $1,091 in capital gains tax but no tax on the return of principal. And the interest you receive will be taxed at your ordinary tax rate.

The upside of an installment sale is it can prevent you from entering into a higher tax bracket in the year of a sale. It may also help you avoid the 3.8% net investment income tax. And because you can charge the buyer interest, this can be a nice source of passive income for you.

Downsides here are you won't receive all the cash upfront, but still have to pay the entire depreciation recapture tax in the year of sale. Also, while you'll have a mortgage on the property, having to foreclose if the buyer defaults can be a hassle.

Deferred Sales Trust (DST)

A deferred sales trust allows you to defer your capital gains tax by selling your property to a third-party trust. The trust then sells the property to the end buyer and retains the full sales proceeds. It will invest the proceeds into any number of investments including real estate, stocks, bonds, etc.

An installment sale arrangement is set up between you and the trust. And you will receive payments over a predetermined number of years, that doesn't necessarily have to start right away. The best part is you'll only pay capital gains tax once you start receiving principal payments from the trust.

A big upside of DSTs is you can receive interest-only payments and essentially defer the capital gains tax indefinitely. This is possible because the trust can invest the proceeds for a return. DSTs can also save you from a big tax bill on a failed 1031 exchange because the qualified intermediary (QI) can release the funds to the DST instead of you.

The downside of DSTs is you have to use a true third-party trustee, which means you have to leave the sales proceeds (the principal) in the hands of someone else to invest on your behalf. And like installment sales, you won't receive cash upfront, but will still have to pay the full depreciation recapture tax in the year of sale.

Monetized Installment Sale

New update 5/24/2021: The IRS has indicated that monetized installment sales do not work in CCA 202118016. Here is additional coverage: https://www.jdsupra.com/legalnews/cash-in-hand-tax-deferral-monetized-9004410/

We are leaving this section up as a means to educate readers on what a monetized installment sale is in case it is pitched to you in the future.

---

A monetized installment sale is a strategy based on an installment sale. It involves finding a buyer for your property, before transferring it to a third-party intermediary, who then sells it to the end buyer and retains the proceeds.

You then obtain an interest-only loan from a third-party lender that is usually around 95% of the sale price of the property. The cash proceeds from the loan are tax-free and you can use them immediately on whatever you see fit. However, if you use them for another business purpose, the interest is tax deductible.

An installment sale arrangement is set up between you and the third-party intermediary. The interest payments you receive are the same amount as the interest payments you have on the loan, making it a wash. The balloon payments on the loan and the installment contracts will align. And the capital gains tax is due when the installment agreement ends. In many cases, this is all set up in escrow accounts and the intermediary facilitates the payments on your behalf.

The Bottom Line

As you now know, a traditional sale isn't your only option for exiting a rental property. By using one of these exit strategies, you can reduce or defer the amount of tax you pay on the sale of a rental property.

Next time you want to sell a property, ask your CPA which one of these strategies makes the most sense for you.